Are you looking for ways to reduce your energy bills and consumption? The European Bank for Reconstruction and Development has developed the Residential Energy Efficiency Financing Facility (MoREEFF) to provide credit lines to reputable Moldovan banks to make loans to householders, Condominiums/Associations of Apartment Owners, Housing Management Companies, Energy Service Companies, or any other eligible service companies providing maintenance, operation, construction and refurbishment services for the purpose of implementing eligible energy efficiency projects in the residential sector in Moldova.

The Benefits of the MoREEFF Facility

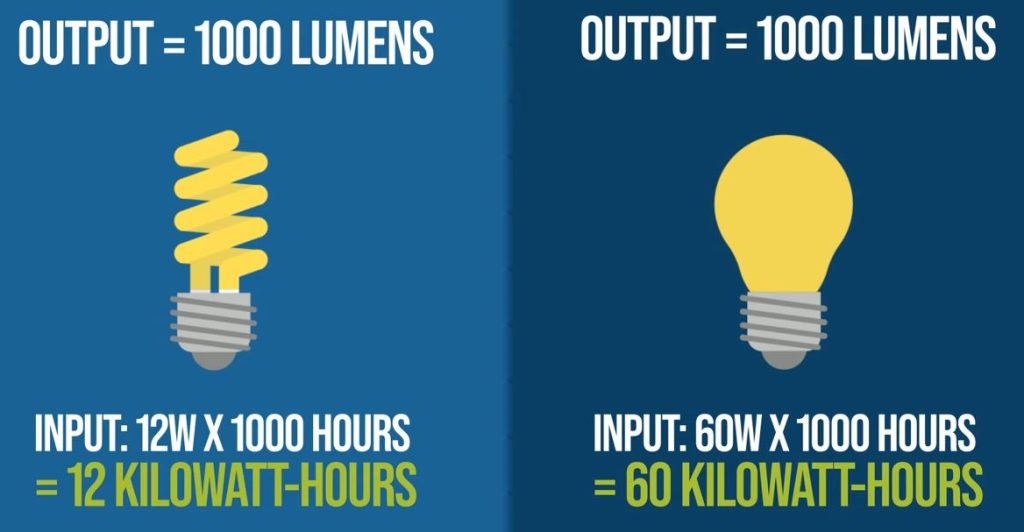

The MoREEFF facility provides loans for energy efficiency home improvements, such as double-glazing; wall, floor, and roof insulation; efficient biomass stoves and boilers; solar water heaters; efficient gas boilers; heat pump systems; building-integrated photovoltaic systems; and heat-exchanger stations and building installations. By investing in these projects, households can reduce their energy bills and consumption, while contributing to a more sustainable future.

But the benefits of the MoREEFF facility do not stop there. To stimulate the uptake of residential energy efficiency projects, the MoREEFF credit lines are complemented by grant funding from the European Union Neighbourhood Investment Facility (EU NIF) and the Swedish International Development Cooperation Agency (SIDA), earmarked in support of project development and investment incentives paid to MoREEFF borrowers after verification that each eligible residential energy efficiency project has been completed. Borrowers can benefit from up to a 35% incentive towards the cost of the energy saving projects subject to the terms and conditions of the MoREEFF.

How to Apply for Your MoREEFF Loan

To take advantage of this opportunity, borrowers need to act fast. The MoREEFF loans and investment incentives are available to MoREEFF borrowers until 30 June 2017. It is anticipated that the total number of energy efficiency home improvement projects to be financed under the MoREEFF facility will be in the range of 8,000.

The application process is straightforward. Interested borrowers should contact a participating Moldovan bank and inquire about MoREEFF loans. The bank will then provide details on the eligibility requirements, loan amounts, interest rates, repayment periods, and any other relevant information. Once the loan is approved, borrowers can proceed with their energy efficiency home improvements, confident in the knowledge that they are taking a positive step towards a more sustainable future.

Conclusion

The MoREEFF facility provides a unique opportunity for Moldovan households to invest in energy efficiency home improvements at an affordable cost. With loans available until 30 June 2017, now is the time to act. By taking advantage of the MoREEFF facility, households can reduce their energy bills and consumption, while contributing to a more sustainable future for all.

FAQs

- What is the MoREEFF Facility? The MoREEFF Facility is a credit line provided by the European Bank for Reconstruction and Development to Moldovan banks to make loans to householders, Condominiums/Associations of Apartment Owners, Housing Management Companies, Energy Service Companies, or any other eligible service companies providing maintenance, operation, construction, and refurbishment services for the purpose of implementing eligible energy efficiency projects in the residential sector in Moldova.

- What types of energy efficiency home improvements are eligible for MoREEFF loans? Eligible energy efficiency home improvements include double-glazing; wall, floor, and roof insulation; efficient biomass stoves and boilers; solar water heaters; efficient gas boilers; heat pump systems; building-integrated photovoltaic systems; and heat-exchanger stations and building installations.